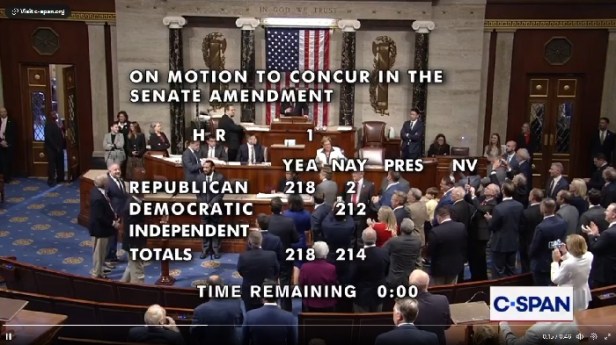

(7-3-25) The ‘One, Big, Beautiful Bill’ passed Into law 218-214 after the House of Representatives passed the bill with Senate Amendments this afternoon.

The Democrats all voted ‘NO’, plus two Republicans (Representative Thomas Massie of Kentucky and Representative Brian Fitzpatrick of Pennsylvania) also voted against the measure.

House Minority Leader Hakeem Jeffries attempted to kill the bill with the longest floor speech on the House floor. During the first months of President Trump’s 2nd term the left has gone to long speeches in an attempt to sway Americans. So far the Democrats have not the stopped the promises made during the campaign by President Trump.

A Look At What The Big Beautiful Bill Does

Below flyer from the White House—

Google AI Overview

The “One, Big, Beautiful Bill,” also known as the “BBB,” is a large piece of legislation focused on tax cuts and economic growth, with a focus on permanent extensions of the 2017 Trump tax cuts. It also includes provisions for increased tax breaks for families, small businesses, and seniors, as well as changes to healthcare and immigration policies.

Here’s a more detailed breakdown of what it does:

For Families:

It aims to make permanent the 2017 Trump tax cuts, which included lower individual income tax rates and increased standard deductions.

Child Tax Credit: . It would boost the child tax credit to $2,200 per child.

No Taxes on Tips and Overtime: . It includes a provision to eliminate federal income taxes on tips and overtime pay.

Health Savings Accounts: . It expands health savings accounts to give families more control over their healthcare spending.

Education Savings: . It expands 529 education savings accounts to help families save for K-12 and postsecondary education.

For Businesses:

- Permanent Tax Cuts: It would make permanent the business tax cuts enacted in the 2017 law.

Expedited Write-offs: It would allow businesses to immediately deduct the cost of equipment and research. Support for Small Businesses: It would expand access to the childcare credit and make the paid leave tax credit permanent.

For Seniors:

- Tax Relief: It introduces unprecedented financial relief for seniors, with 88% of those receiving Social Security paying no tax on their benefits.

Expanded Standard Deduction: It doubles the standard deduction for seniors.

Other Notable Provisions:

The bill also includes provisions related to Medicaid, aiming to eliminate waste, fraud, and abuse, while enforcing work requirements.

Immigration: . It includes provisions related to immigration, such as removing illegal aliens and enforcing work requirements.

Potential Impacts:

- Economic Growth: Supporters believe the bill will boost the economy, citing potential increases in GDP and job creation.

Deficit: Critics argue that the bill will significantly increase the national debt. Healthcare: Some healthcare providers worry that cuts to Medicaid could negatively impact their ability to care for vulnerable patients.